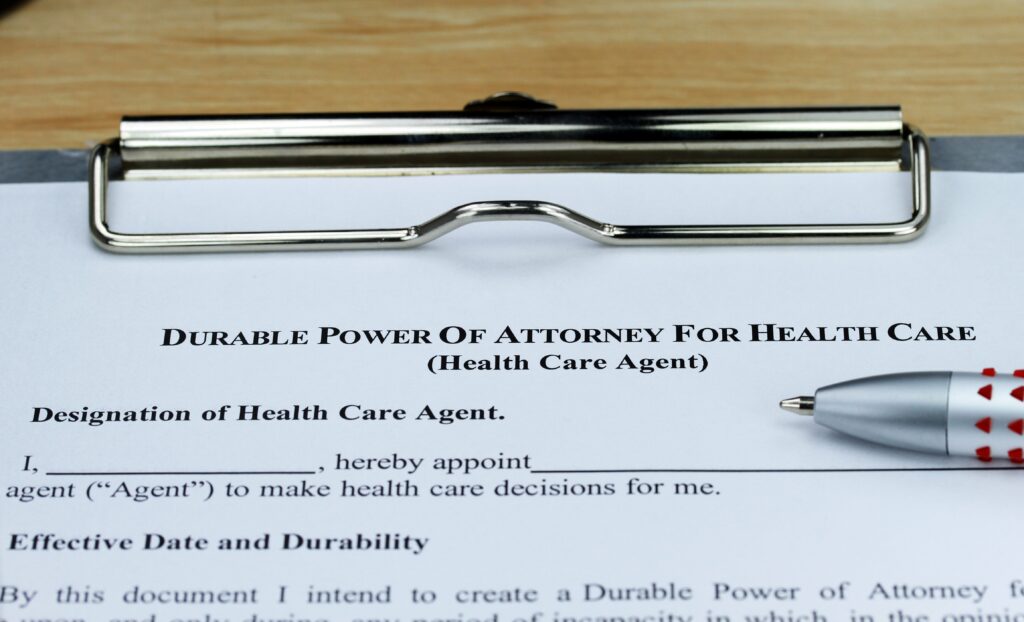

How and When Does a Durable Power of Attorney Go Into Effect?

There’s no doubt that a Durable Power of Attorney (DPOA) is an important part of your estate plan. Ideally, if it’s well crafted and updated, a DPOA will protect both you and your assets by enabling someone you have deep trust in, to take care of both your healthcare decisions and decisions concerning your estate….

What You Need to Know About a Durable Power of Attorney in 2018

There are several different types of Powers of Attorney (POA). Regardless of the kind of Power of Attorney we are talking about, you are essentially enabling someone else to act on your behalf. Often, you will sign a POA for legal representation, or for other situations in which you might want someone to be able…

How Do I Appoint a Guardian For My Child If I Die?

Who Would Raise Your Children If Something Happened to You? Honestly, no one wants to think about this question. It’s an implicit reminder that we are indeed mortal, and, in some cases, we may leave this world before we are ready. Who will you leave your child with if you die? What are our…

Why You Need to Update Your Estate Plan After These Life Events

Too many estate plans are created and then quickly forgotten, put on a shelf, and never looked at again. While we do recommend that you review and update your estate plan at least every three years, no matter what happens in your life, your plan must be updated immediately in the event of any of…