What to Know During the Guardianship Nomination Process

Do you know about the guardianship nomination process? If something happened to you and you were unable to take care of yourself or your children, who would step in? Ideally, it would be someone you chose. Nominating a guardian before something happens allows you to do just that. What Is a Guardian? Think back to…

Maximizing Tax Umbrellas for Estates

How can you maximize tax umbrellas? Estate tax can rip as much as 40% of your family’s assets from them, depending on the value of your estate and its location in the country. Right now is the time to protect your estate from federal and state taxes. If you take the time to create a well…

Planning Pitfalls: The Most Common Estate Planning Mistakes

Most people do not like to think about their eventual demise, and they certainly don’t like asking uneasy questions about estate planning. In fact, 6 in 10 adults in the United States do not have a will or living trust. And that is a problem, considering how many people want their assets to pass on to their…

What to Expect From (and How to Prepare For) an Initial Estate Planning Meeting

Whether you have met with an estate planning attorney before or it is your first time, it is important to understand how working with an Estate Lawyer is different than meeting with a traditional lawyer. This article will explain what is involved with such a consultation, and it may even inspire you to meet with…

Break Down Estate Planning By Using These Worksheets

Estate planning is not something you are probably thinking about… especially if you are decades out from retirement. It is one of those things we all know we should do but don’t think about until we are much older. Sometimes, sadly, we do not think about it until it is too late. However, regardless of…

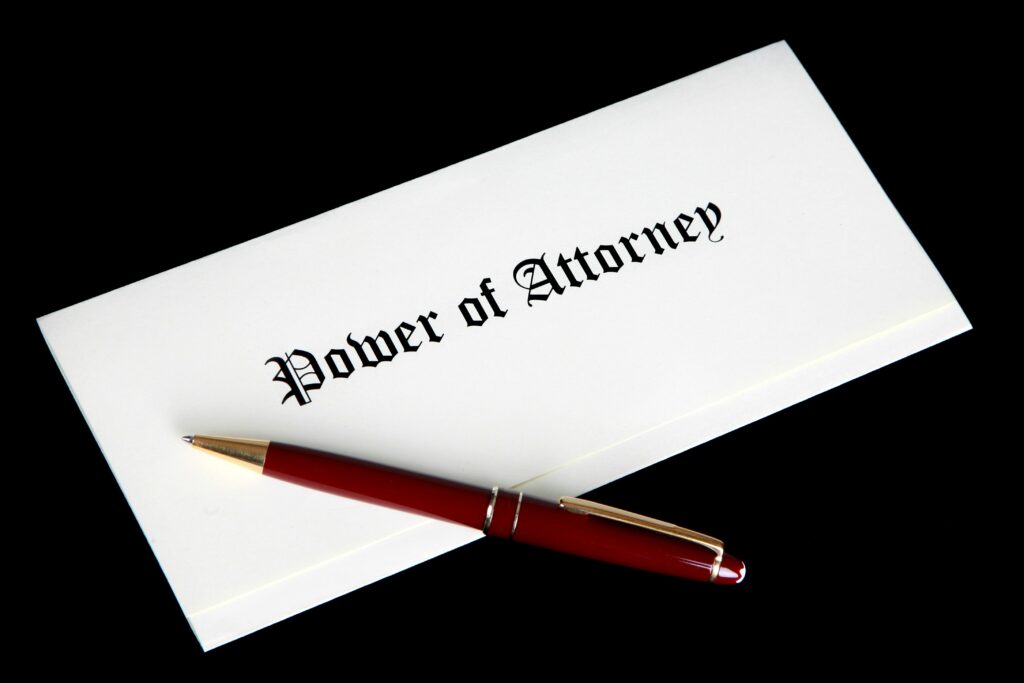

Who Can Help Create a Durable Power of Attorney in WA State

Most of us do not like to think about it, but what happens if we are unable to make our own decisions regarding our health and finances? Who is going to make those decisions for us? Are the decisions being made what we would decide if we could? Having a durable power of attorney in…

A Young Family’s Guide to a Rock Solid Estate Plan

What does a young family need for a rock solid estate plan? If you are under 40 years old, the chances of you have thought about, or even pursuing estate planning is pretty small. However, something brought you here, and that means you are on your way to changing the way you look at planning…

How To Choose An Estate Planning Attorney

In addition to this blog, there are hundreds of programs out there to help you in planning various parts of your estate. However, estate planning is much more than filling in your name in a computer program and having a document printed on your computer. A rock solid estate plan requires having someone who knows…